How to Become a CPA with Sinclair's Complete Educational Pathway

Steps to Become a CPA

1. Fulfill the Educational Requirements

To be eligible to take the CPA exam you need 150 credit hours (about 5 years of college). Your college courses must include:

- 24 semester hours of business courses

- 30 semester hours of accounting courses

You can take all of these courses at Sinclair with these 2 programs. Sinclair's CPA programs are designed for the student to obtain the accounting courses to sit for the CPA exam.

- CPA Exam Eligibility Certificate: Business Component

(courses needed if your bachelor’s degree is not in a business area) - CPA Exam Eligibility Certificate: Accounting Component

Save on the total cost of your Bachelor's degree by starting at Sinclair and transferring to a four-year university. For students who already have their Bachelor's degree and want to further their education or change careers, they can transfer into Sinclair with ease.

Students who live inside Montgomery County receive tuition discounts. On average Sinclair is half the statewide average cost for tuition.

*Total cost is subject to change and does not include textbooks or other course fees. Not all courses may be available online. View the Bursar current fee and tuition schedule here.

*Total cost is subject to change and does not include textbooks or other course fees. Not all courses may be available online. View the Bursar current fee and tuition schedule here.

Your Next Step:

Contact accounting department chair Rick Andrews at 937-512-2615 to schedule a consultation OR complete this contact form for more information about enrolling in the Sinclair CPA program:

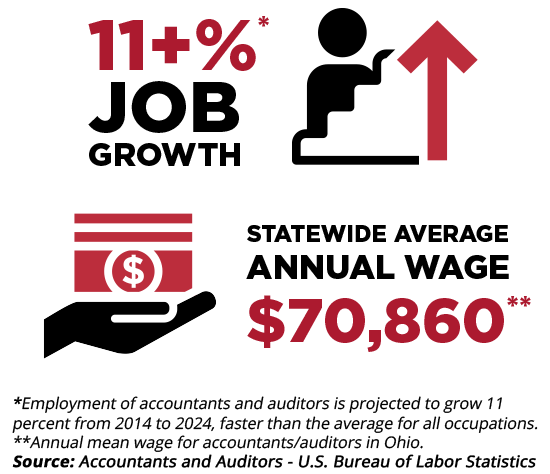

CPA's Are a Valuable and in

Demand Career Field

2. Pass the CPA Exam

Students can schedule to take the CPA examination with the Accountancy Board of Ohio after completing all of the educational requirements. You'll want to send all of your official transcripts to the Accountancy Board of Ohio for review with your exam application and pay the application fee.

CPA Exam Requirements

- Be at least 18 years of age prior to sitting for the CPA exam

- 150 college credit hours (24 semester hours of business course AND 30 semester hours of accounting courses)

Once the board had approved your application, they will send you notification to schedule to take the selected exams sections. Each of the four exam sections have a fee that has to be paid before you can take the section.

View the Accountancy Board of Ohio Exam Fees and examination sites.

3. Meet the Work Experience Requirement

You must have over four years of accounting experience, with required experience performing one or more accounting services.

View the Ohio Board rule for experience requirements for CPA Certificate.

4. Take the PSR Course

You will need to take a Board approved course in professional standards and responsibilities (PSR), which emphasizes Ohio accountancy law and Board rules.

View Board sponsors who offer the approved PSR course.

5. Obtain your Ohio CPA Certification

Once you meet all of the Accountancy Board of Ohio requirements, you can submit your application for an Ohio CPA Certificate. View the full Ohio code requirements for CPA Certificate.

CPA Certificate Requirements

- Be an Ohio resident, employee OR have an office in state

- Be at least 18 years of age

- PSR course completed within the last year

- Meet the education and experience requirements

- Successful completion of FBI and BCI criminal record checks

You'll need to submit with your application several documents verifying your information. View the Ohio CPA certification requirements and procedures. The Ohio office approves applications for certifications on the 15th of each month, excluding December.